Tokenomics

Distribution, Vesting & Design

This page summarises the token distribution, vesting and governance design. The aim is clarity: what the token is for, how supply is allocated, and how lock-ups work.

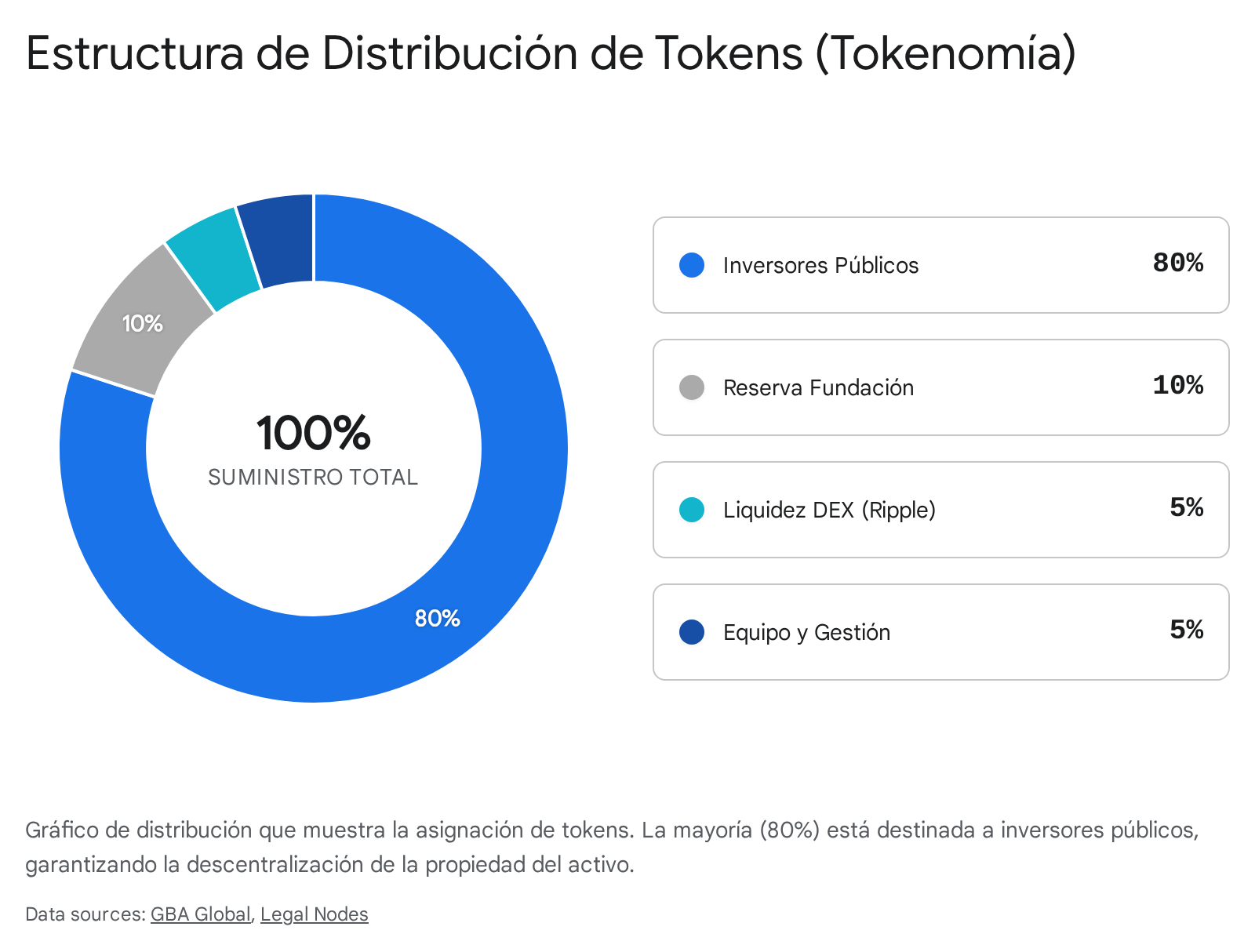

Distribution (80/10/5/5)

80%

Real-world asset (RWA) acquisition & on-chain collateralisation

10%

Liquidity & market infrastructure

5%

Team & operations (subject to vesting)

5%

Community & incentives programmes

Vesting & lock-ups

Principle

Lock-ups and vesting reduce sell-pressure risk and align long-term incentives.

Transparency

Vesting schedules should be auditable and disclosed alongside treasury movements.

REIT model vs. XRPL-native tokenisation

Traditional REIT

- •Settlement and ownership are handled by intermediaries.

- •Investor transparency depends on periodic reports.

- •Liquidity is constrained to market hours and venues.

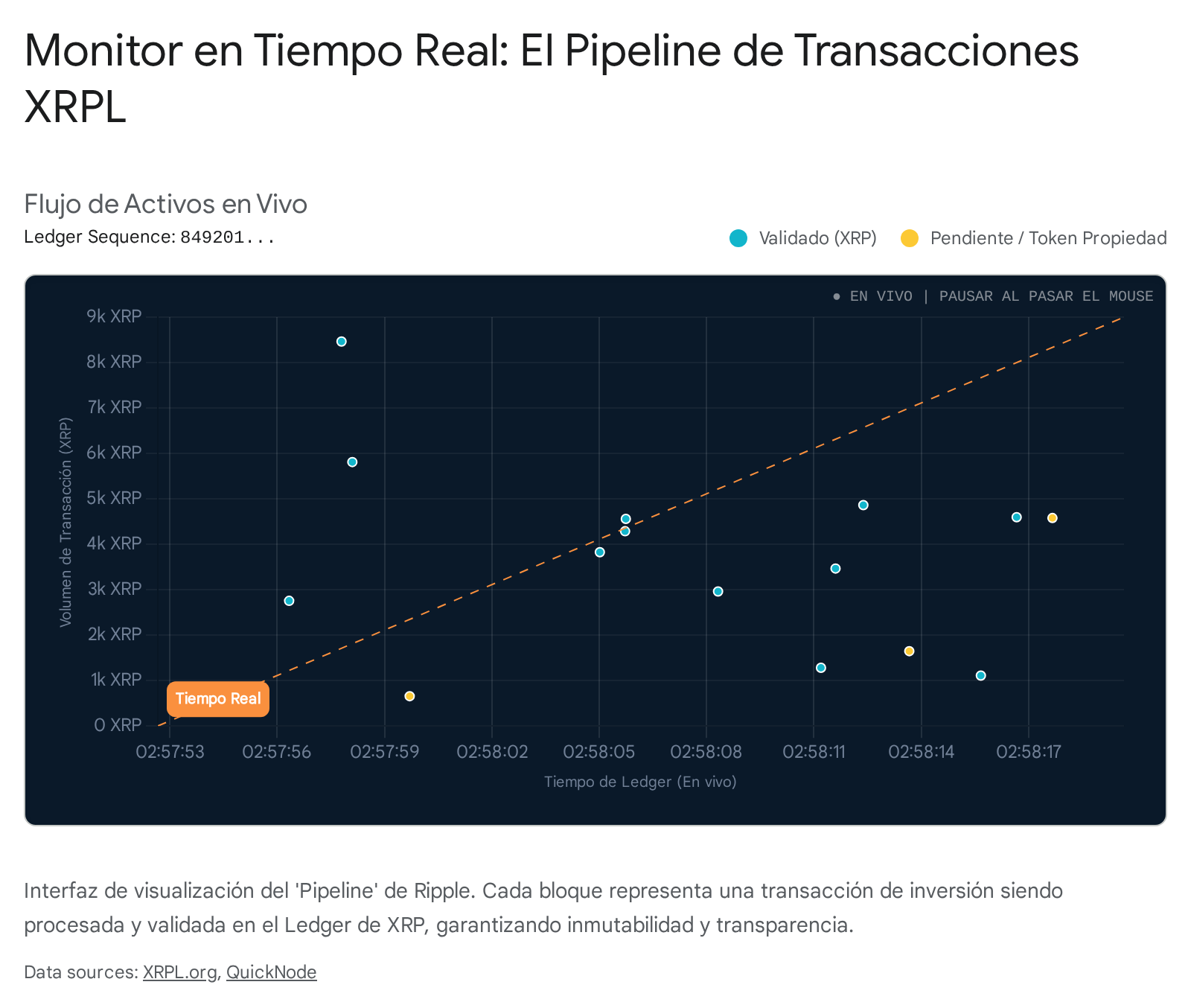

XRPL-native tokenisation

- •Ownership and transfers can be represented and settled on-ledger.

- •On-chain movement is observable and can be presented in near real time.

- •Programmable liquidity and 24/7 transfer rails (subject to compliance controls).

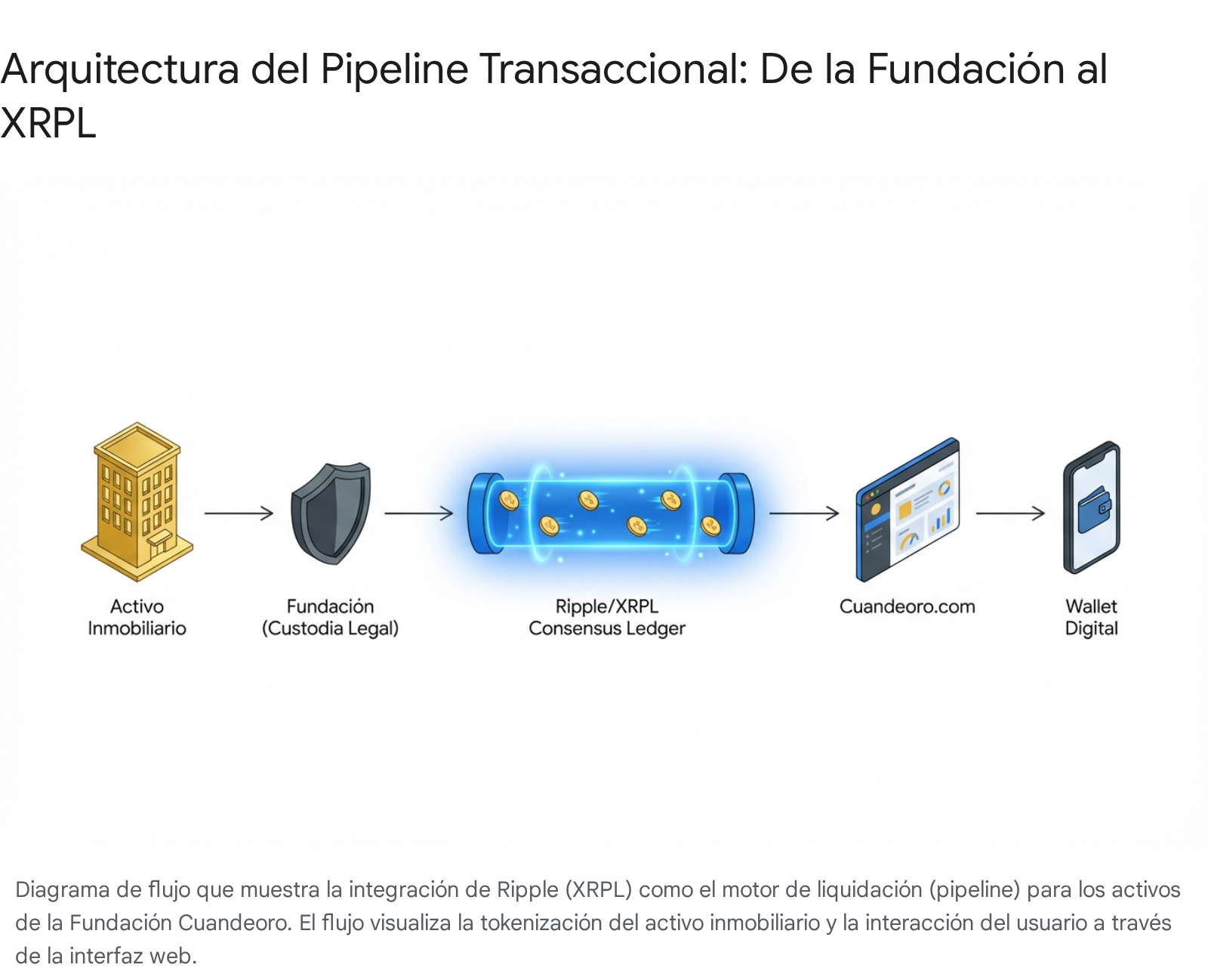

How it connects to the XRPL pipeline

For the architectural view and the “Ripple Connection” explanation, see The Ripple Connection.

Next

If you want the architectural view, start with The Ripple Connection. For assumptions and risk statements, read the Whitepaper.